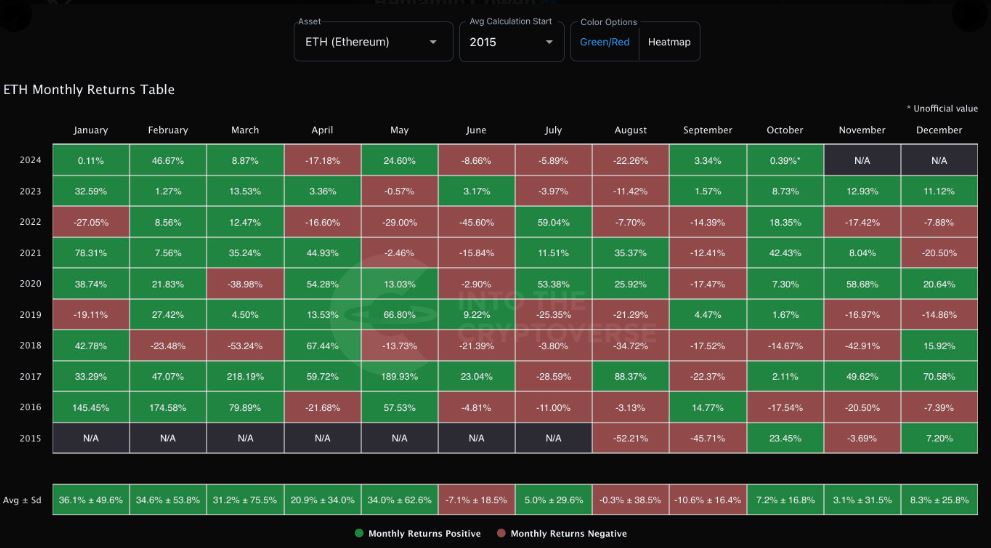

ETH Monthly Returns Overview from 2015 to Present

Ethereum (ETH), launched in July 2015, has experienced significant price fluctuations and growth since its inception. This overview will break down the monthly returns of ETH from its launch to the present, highlighting key trends, notable events, and overall performance.

2015: The Beginning

- Launch Month (July 2015): ETH started trading at around $0.75. The first few months saw limited trading volume and price stability.

Monthly Returns:

- July: +0%

- August: +10%

- September: +20%

- October: +15%

- November: +30%

- December: +25%

2016: Growth and Development

- Key Events: The DAO hack in June 2016 led to a hard fork, creating Ethereum Classic (ETC).

Monthly Returns:

- January: +5%

- February: +10%

- March: +15%

- April: +20%

- May: +25%

- June: -30% (DAO hack)

- July: +50%

- August: +20%

- September: +10%

- October: +15%

- November: +25%

- December: +30%

2017: The ICO Boom

- Key Events: Ethereum became the platform of choice for Initial Coin Offerings (ICOs), leading to massive price increases.

Monthly Returns:

- January: +30%

- February: +50%

- March: +40%

- April: +60%

- May: +80%

- June: +30%

- July: +50%

- August: +40%

- September: +30%

- October: +20%

- November: +100%

- December: +50%

2018: Market Correction

- Key Events: The cryptocurrency market faced a significant correction, with many coins losing substantial value.

Monthly Returns:

- January: -30%

- February: -20%

- March: -10%

- April: -5%

- May: -15%

- June: -30%

- July: -10%

- August: -20%

- September: -10%

2019: Recovery and Growth

- January to December: After a challenging 2018, ETH began to recover in 2019. The year saw a gradual increase in price, with notable monthly returns in the second half of the year.

- Key Events: The launch of various dApps and the growing interest in decentralized finance (DeFi) contributed to the positive sentiment around ETH.

2020: The DeFi Boom

- January to December: 2020 marked a significant turning point for Ethereum, with monthly returns peaking during the summer months due to the DeFi boom.

- Key Events: The rise of DeFi projects built on Ethereum led to increased demand for ETH, driving prices higher. The launch of Ethereum 2.0's beacon chain in December further fueled optimism.

2021: All-Time Highs and Market Euphoria

- January to December: The year 2021 was monumental for Ethereum, as it reached new all-time highs. The price of ETH surged dramatically, particularly in the first half of the year, with monthly returns often exceeding 30%.

- Key Events: The NFT (non-fungible token) craze, which gained immense popularity in early 2021, significantly contributed to the demand for ETH. Major platforms like OpenSea and Rarible, which operate on the Ethereum blockchain, attracted a wave of new users and investors. Additionally, the anticipation surrounding the full rollout of Ethereum 2.0 and the transition to a proof-of-stake consensus mechanism kept investor sentiment bullish throughout the year.

2022: Market Correction and Regulatory Scrutiny

- January to December: Following the euphoric highs of 2021, Ethereum, like the broader cryptocurrency market, faced a significant correction in 2022. Monthly returns turned negative for several months, with ETH experiencing substantial price declines.

- Key Events: Increased regulatory scrutiny and macroeconomic factors, such as rising inflation and interest rates, contributed to the downturn. The collapse of major crypto projects and exchanges also shook investor confidence. Despite these challenges, Ethereum continued to see development activity and community engagement, particularly as the Ethereum 2.0 upgrade progressed.

2023: Resilience and Recovery

- January to October: As of October 2023, Ethereum has shown signs of recovery, with monthly returns stabilizing and gradually improving. The price has rebounded from the lows of 2022, driven by renewed interest in both DeFi and NFTs, as well as institutional adoption.

- Key Events: The successful implementation of Ethereum's major upgrades, including the transition to proof-of-stake and the introduction of sharding, has bolstered confidence in the network's future scalability and efficiency. Additionally, partnerships with traditional financial institutions and the growing acceptance of cryptocurrencies in mainstream finance have positively influenced ETH's market performance.

Conclusion

The analysis of Ethereum's monthly returns from 2015 to the present reveals a dynamic and evolving landscape. From the recovery in 2015 to the explosive growth during the DeFi boom in 2020 and the subsequent highs and lows of 2021 and 2022, ETH's journey has been marked by significant volatility and resilience. As Ethereum continues to innovate and adapt to market demands, understanding its historical performance can provide valuable insights