2026 Outlook: Tax Reform Update and Trading Investment Plan Communication

Dear Valued Clients and Esteemed Investors,

We extend our sincere appreciation to you for your continued trust, cooperation, and partnership with Akinyele Oluwale & Co. Your confidence and commitment remain fundamental to our ability to serve you effectively across our tax advisory and trading investment plan engagements.

Tax Reform Update

We commend our clients for their consistent fulfillment of tax obligations and their contribution to Nigeria’s socio-economic development during the last fiscal year. Your compliance—whether as corporate entities or individual taxpayers—plays a critical role in national growth, infrastructure development, and public service delivery.

As we transition into 2026, Nigeria’s ongoing Tax Reform agenda is aimed at building a fairer, simpler, and more growth-oriented tax system. Key developments include enhanced tax administration through expanded digital platforms, the transition from FIRS to the Nigeria Revenue Service (NRS), reduced compliance burdens, and improved taxpayer services. Importantly, the reforms prioritize broadening the tax base rather than increasing tax rates, encouraging voluntary compliance, and strengthening transparency and accountability in tax revenue utilization.

Corporate taxpayers continue to benefit from reforms that support ease of doing business, clearer regulatory guidance, and incentives for investment and job creation. Individual taxpayers equally benefit from improved taxpayer identification systems, balanced enforcement mechanisms, and increased taxpayer education and awareness.

We remain fully committed to keeping you informed, compliant, and strategically positioned under the evolving tax landscape.

Trading Investment Plan Update

Reflecting on the 2025 financial year, we sincerely appreciate your patience, trust, and confidence in our investment operations. The year presented significant global and local market challenges that impacted financial markets broadly. These conditions contributed to the delayed and, in some instances, failed payouts experienced during the period.

We wish to clearly reaffirm that these setbacks were driven by market conditions and not by any lack of commitment, integrity, or operational diligence on our part.

Looking ahead to 2026, we remain firmly focused on stabilizing operations and addressing outstanding payout obligations. Strategic measures are already being implemented to mitigate market risks, strengthen performance, and enhance resilience. We are confident that these steps will support improved outcomes in the near term.

We deeply value your partnership and remain committed to transparency, accountability, and sustainable long-term growth.

Thank you for your continued support as we move forward together.

Yours faithfully,

Akinyele Oluwale & Co.

A massive sell-off worth $1.65 trillion swept through the market on Friday, impacting bitcoin mining stocks and wiping out tens of millions in value among the top 20 publicly traded companies. This decline reflected the wider losses seen in U.S. stock markets, underscoring the increasing vulnerability of the sector to macroeconomic factors and changes in investor sentiment.

Global Sell-off Triggers Volatility in Crypto Mining Stocks

In yesterday's market decline, statistics from bitcoinminingstock.io reveal that IREN Limited (IREN) maintained its status as the top bitcoin mining firm by market capitalization, valued at $16.21 billion, despite a 6.38% drop in its stock price to $59.77. In contrast, Applied Digital Corporation (APLD) emerged as a notable exception, experiencing a 16.04% increase to $33.99, boosting its valuation to $9.51 billion.

Bitmine Immersion Technologies (BMNR), known for its ETH treasury operations, faced one of the most significant daily losses, plummeting 11.29% to $52.47, with a market cap of $9.09 billion. Riot Platforms (RIOT) and MARA Holdings (MARA) also encountered considerable declines of 5.70% and 7.67%, respectively, closing at $21.01 and $18.65 on Friday afternoon.

Within the mid-cap sector, Cipher Mining (CIFR) dropped 5.66% to $16.97, holding a valuation of $6.67 billion, while Core Scientific (CORZ) achieved a modest gain of 2.66% to $18.52, raising its market cap to $5.65 billion. Cleanspark (CLSK) fell 4.03% to $19.28, maintaining a market value of $5.42 billion, and Terawulf (WULF) experienced a slight decline of 0.58% to $13.51. Hut 8 Corp. (HUT) saw a decrease of 6.01% to $43.57, rounding out the top ten with a market cap of $4.6 billion.

Among the smaller-cap miners, Bitdeer Technologies (BTDR) faced the largest drop of the day, down 13.31% to $17.78, with a valuation of $3.77 billion. Bitfarms (BITF) provided a rare positive highlight, increasing by 0.71% to $4.20. HIVE Digital Technologies (HIVE) fell 5.02% to $6.61, while Northern Data AG (NB2.DE) decreased by 1.74% to $19.73. Bit Digital (BTBT) dropped 6.46% to $3.76, and American Bitcoin Corp. (ABTC) fell 9.16% to $5.95.

Further down the rankings, Cango Inc. (CANG) saw a 7.01% decrease to $4.31, Bitfufu Inc. (FUFU) fell 4.34% to $3.74, and Canaan Inc. (CAN) experienced a sharp decline of 10.65% to $1.09. In contrast, Digi Power X Inc. (DGXX) defied the overall market trend, rising 15.53% to $3.05, although it remains the smallest company in the group with a market cap of $136.36 million.

The increasing partnership between traditional finance and blockchain companies like Ripple is propelling Europe’s progress in adopting digital assets. On October 10, Ripple’s Managing Director for the U.K. and Europe, Cassie Craddock, shared on the social media platform X that the European Union’s Markets in Crypto-Assets Regulation (MiCA) has bolstered institutional trust in blockchain integration.

"MiCA has empowered European banks and financial institutions [FIs] to engage more deeply with the industry," Craddock stated, further adding:

Consequently, we are witnessing numerous banks and FIs, including Societe Generale and BBVA, developing digital asset custody and tokenization capabilities in collaboration with crypto-native firms like Ripple.

Nevertheless, she pointed out that despite these advancements, "many obstacles still exist to realize the full potential."

Craddock elaborated that tokenization aligns with the European Union’s objectives for a savings and investment union by reducing costs, enhancing efficiency, and broadening access to funding and investment opportunities for businesses.

She warned that global rivals are swiftly moving to leverage blockchain innovation and urged the EU to "act quickly and sustain the momentum" to preserve its competitive edge. The Ripple executive expressed:

We are genuinely enthusiastic about the prospects for the blockchain sector in Europe and eager to contribute to shaping the future of tokenization.

Her remarks underscore both a sense of optimism and a call to action as Europe aims to strengthen its position in digital finance through the regulatory clarity provided by MiCA and collaborative efforts within the industry.

Bank of England Governor Andrew Bailey has detailed plans to allow widely utilized stablecoins access to central bank accounts, while cautioning that these tokens could transform Britain’s financial landscape.

As reported by the Financial Times, Bailey characterized stablecoins as a technology capable of decoupling money holding from credit provision, which could potentially diminish the influence of commercial banks within the economy.

The governor asserts that this transition would necessitate careful oversight to maintain the connection between money and credit creation that is essential for economic activity.

His remarks come as the Bank of England prepares to release a consultation paper regarding its systemic stablecoin framework, which will establish standards for tokens that are used extensively for everyday transactions or for settling tokenized financial markets.

BoE Suggests Access to Central Bank Accounts Due to Deposit Drain Worries

Bailey clarified that the current financial system in Britain merges money holding with credit provision through fractional reserve banking, where deposits from commercial banks directly facilitate lending to households and businesses.

He pointed out that stablecoins could enable a different structure where money and credit provision are somewhat distinct, allowing banks and stablecoins to coexist while non-banking entities engage in more lending activities.

The central bank has also suggested ownership caps ranging from £10,000 to £20,000 for individuals and £10 million for corporations concerning systemic stablecoins.

Sasha Mills, the Bank’s executive director for financial market infrastructure, mentioned that these limits would “reduce financial stability risks arising from significant and swift withdrawals of deposits from the banking sector.”

Bailey emphasized that the assets backing stablecoins must be devoid of credit, interest, and exchange rate risks to maintain value stability, and should be supported by insurance schemes and statutory resolution frameworks akin to those for bank deposits.

He further stated that exchange terms need to be transparent, consistent, and easily convertible into other forms of money, rather than reliant on crypto exchanges and their operational terms.

The governor recognized that while the technology behind stablecoins is innovative, it raises a longstanding central banking issue regarding the assurance of the connection between money and credit creation.

Crypto Sector Opposes Proposed Stablecoin Limitations

Tom Duff Gordon, the vice-president of international policy at Coinbase, expressed to the Financial Times that "setting limits on stablecoins is detrimental to UK savers, harmful to the City, and adverse for sterling," noting that no other significant jurisdiction has found such caps necessary.

In a similar vein, Simon Jennings, executive director of the UK Cryptoasset Business Council, contended that "restrictions simply do not function effectively in reality" since stablecoin issuers are unable to track token holders in real time.

He cautioned that implementing caps would necessitate expensive new systems, such as digital IDs or ongoing coordination between wallets.

Riccardo Tordera-Ricchi, director of policy at The Payments Association, also remarked, "just as there are no restrictions on cash, bank accounts, or e-money, there is no justification beyond skepticism for imposing limits on stablecoin ownership."

This backlash risks escalating tensions between the Bank of England and the Treasury after Chancellor Rachel Reeves pledged in her Mansion House address to "advance developments in blockchain technology, including tokenized securities and stablecoins."

In light of the persistent criticism, the Bank of England has indicated that its suggested limits could be "transitional" as the financial system adapts to the rise of digital currency.

AI is set to boost innovation and efficiency across various industries, sectors, and facets of our lives, undoubtedly driving enhancements in technology such as Bitcoin regarding efficiency and, ideally, scalability. But what about stocks? Is the idea of investing in them becoming obsolete? Let’s delve deeper into this topic.

What is the argument for investing in stocks?

The first stock market in the world emerged in Amsterdam in 1602 with the establishment of the Dutch East India Company. Initially, it served as a venue for trading shares of the company, but it quickly evolved into a blueprint for capital raising and investment. By the late 17th century, London had created its own trading centers, while New York's stock exchange would not appear until 1792, thereby extending this model across the Atlantic.

Stocks signify ownership in corporations, and the stock market is the platform where investors engage in buying and selling these shares. The values of stocks vary according to company performance and market dynamics, including their capacity to adapt to technological advancements such as AI.

Companies that have embraced technological progress throughout history have weathered economic downturns, wars, and the disruptions brought about by technology. Without the advantage of hindsight, it appears that the same could hold true for firms investing in AI.

In particular, businesses that leverage AI through automation, data analysis, and innovative business strategies are poised for success.

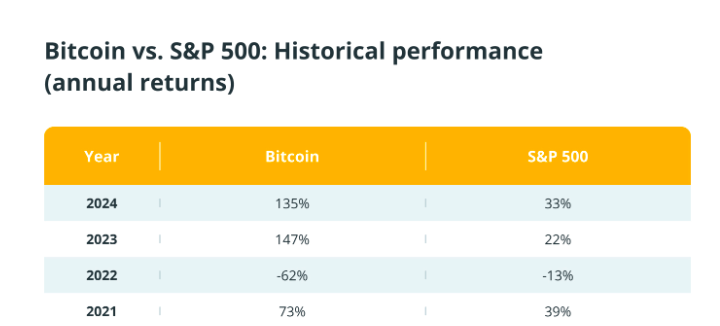

Historically, market indices like the S&P 500 have provided around 7%-10% annualized returns over the years, adjusted for inflation. This index monitors the performance of 500 of the largest publicly traded companies in the US and is commonly regarded as a standard for the overall stock market.

In comparison to the S&P 500, Bitcoin's BTC $112,030 performance has been remarkably superior, as illustrated in the accompanying table.

What is the argument for Bitcoin?

Bitcoin is a relatively recent innovation, developed in 2009 by the anonymous Satoshi Nakamoto.

The initiative was presented in a white paper that outlined a peer-to-peer electronic cash system utilizing blockchain technology.

The argument for Bitcoin extends beyond merely being an investment vehicle or a store of value. It proposes a genuine monetary revolution that competes with gold and other financial instruments.

Its decentralized structure defies central authority and the inflation typically seen in fiat currencies. With a limited supply capped at 21 million coins, Bitcoin’s scarcity attracts those looking for a safeguard against monetary devaluation.

Additionally, the transparency and security of blockchain are well-suited to the requirements of AI for reliable data.

Throughout the years, Bitcoin has positioned itself as both a store of value and an alternative currency, while still aiming to achieve its initial objective of becoming a widely accepted medium of exchange.

How AI influences stocks and the stock market

The upcoming 50 years may pose a significant challenge to the stock market's existence as a fundamental institution, as noted by analyst and investor Jordi Visser, who suggests that "artificial intelligence is accelerating innovation cycles, rendering public companies less effective as investment options."

Stocks have existed for a considerable time, yet AI-driven changes create little space for complacency, and firms that do not evolve risk being left behind. This is particularly relevant for major tech players like the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google). Although they are some of the largest investors in AI, these companies must continue to adapt to swift advancements and implement them successfully.

AI will also influence the stock market by rapidly processing vast amounts of data, forecasting market trends, and automating decision-making processes, leading to quicker and more efficient operations. The presence of AI will significantly alter how investors approach trading and investment strategies.

In summary, AI is expected to enhance corporate innovation while simultaneously increasing the divide between firms that can adapt and those that remain stagnant.

The Impact of AI on Bitcoin

Visser views Bitcoin as a superior investment for the future, likening it to gold, which has stood the test of time for millennia.

In addition to serving as a store of value, Bitcoin is strategically positioned for the future of finance. The synergy between AI and blockchain has the potential to disrupt conventional financial systems, attracting more capital and participants into the digital economy.

AI is anticipated to enhance Bitcoin's security and trading strategies, optimizing crypto trading through automated tools, improved data analysis, and market pattern forecasting. These advancements could also lead to greater system efficiency.

Moreover, Bitcoin mining is set to gain from AI, particularly in terms of efficiency and resource management by predicting the best times for mining operations to cut costs and maximize production. System upkeep will also see improvements as AI can identify current or impending failures, thus boosting overall reliability.

Nonetheless, Bitcoin is confronted with regulatory challenges, scalability concerns, and volatility, which may dissuade risk-averse investors who typically favor more stable and predictable investment options like stocks.

The merging of AI and blockchain could usher in a new chapter for Bitcoin, fostering wider adoption by establishing a more intuitive and secure ecosystem, giving it a competitive advantage over stagnant stocks.

Which entities will thrive over the next 50 years?

Looking ahead 50 years is nearly impossible. Both Bitcoin and stocks possess distinct advantages and disadvantages, and their futures are ultimately influenced by economic, technological, and societal shifts. Stocks are likely to persist if they evolve alongside AI-driven economies. Investors can reduce the risks associated with individual company failures by investing in diversified portfolios, such as index funds, which seem to offer greater security. Stocks in sectors like robotics, biotech, space, and AI may outperform those that are less technology-focused.

The emergence of quantum computing is frequently mentioned concerning Bitcoin’s security framework, although most experts concur that the risk remains theoretical and far off. When combined with AI, its effects could be either beneficial or detrimental, depending on how the technology develops and how the Bitcoin network responds. Mining centralization could also pose a risk if only a handful of entities gain early access to advanced quantum-AI technologies.

Conversely, this combination might be enhancing Bitcoin’s security and optimizing the network by improving transaction processing, wallet security, or blockchain analytics, thereby boosting Bitcoin’s efficiency and user experience. Provided the Bitcoin community remains proactive with quantum-resistant upgrades, the overall impact could be favorable. As decentralized finance continues to gain momentum in investments, Bitcoin is also strengthening its competitive position against gold. In doing so, it is establishing itself as a superior store of value and prompting traditional markets to redirect funds towards digital finance.

Michael Saylor, the executive chairman of Strategy, asserts that the most severe critics of the company are not retail investors or analysts, but rather a coordinated network of bots financed by short sellers.

In a recent discussion with podcaster Natalie Brunell, Saylor claimed that negative online sentiment is being artificially amplified.

"A short seller of my stock has actually hired a digital marketing firm to generate a multitude of bots that spread a wave of nasty, terrible, and skeptical cynicism," he stated.

"It’s very clear to me that someone has invested money to create the illusion of a protest."

Strategy Stock Reaches Five-Month Low Despite Minor Bitcoin Decline

The comments come as Strategy’s stock hovers around five-month lows, dropping to $323 last week even with only an 8% decrease in Bitcoin from its latest peak.

The company, currently valued at $97 billion, has become a key player in corporate Bitcoin investment under Saylor’s guidance.

Nonetheless, not everyone is persuaded by Saylor’s assertions. Veteran short seller Jim Chanos, renowned for uncovering Enron, responded on X: “This is a pretty serious allegation stated as a fact,” he remarked. “Most of the mNAV bears have been quite open about their reasoning.”

Chanos has consistently raised alarms about Strategy’s financial model, which focuses on issuing Bitcoin-backed preferred shares to gather more BTC. He likened the firm’s strategy to the speculative excitement of the 2021 SPAC boom.

“We are witnessing SPAC-like 2021 figures in the Bitcoin treasury market at this moment,” Chanos cautioned in July.

He has also criticized Strategy’s valuation approach, which prompts investors to apply a multiple not just to the company’s existing Bitcoin assets but also to the anticipated growth of those assets.

“Mr. Saylor wants you to assess his business based not only on the net worth of his Bitcoin assets but also with a multiple on the variation in that NAV,” Chanos stated.

“Because now he can leverage his balance sheet, lol.

Saylor’s Strategy Acquires 7,714 BTC in August as Bitcoin Falls Below $108K

Michael Saylor’s Strategy added 4,048 BTC for $449.3 million between August 25 and Monday, raising its total holdings to 636,505 BTC.

The latest acquisition occurred as Bitcoin’s price briefly reached $113,000 before dropping below $108,000, with an average purchase price of $110,981 per coin.

In total, the Strategy secured 7,714 BTC throughout August, a decrease from 31,466 BTC in July, through various smaller transactions, including 3,081 BTC last week.

The firm has now invested approximately $46.95 billion in its Bitcoin reserves, averaging $73,765 per coin.

As reported, Saylor has entered the ranks of the world’s wealthiest individuals, making his debut on the Bloomberg Billionaire Index this week with an estimated net worth of $7.37 billion.

The majority of Saylor’s wealth, around $6.72 billion, is linked to his equity in Strategy, the Nasdaq-listed company recognized for its bold Bitcoin accumulation approach.

Bloomberg estimates that an additional $650 million of Saylor’s assets are held in cash.

The billionaire joins other leaders in the crypto industry on Bloomberg’s top 500, including Coinbase CEO Brian Armstrong, who is currently ranked 234th with $12.8 billion, and Binance founder Changpeng “CZ” Zhao at 40th with $44.5 billion.

How Do Lower Interest Rates Affect Mortgage Rates?

Mortgage rates usually decrease before and during a phase of interest rate reductions: The average 30-year fixed-rate mortgage fell to 6.35% from 6.5% last week, marking the lowest point since October 2024, as reported by mortgage buyer Freddie Mac. The borrowing costs for 15-year fixed-rate mortgages also decreased to 5.5% from 5.6%, approaching the rate from a year ago of 5.27%. When the Federal Reserve reduced the funds rate to a range of 0% to 0.25% during the pandemic, 30-year mortgage rates reached historic lows between 2.7% and 3% by the end of 2020, according to data from Freddie Mac. Consumers who refinanced their mortgages in 2020 saved approximately $5.3 billion each year as rates fell, as stated by the Consumer Financial Protection Bureau. In a similar vein, mortgage rates surged to around 7% when interest rates were increased in 2022 and 2023, although mortgage rates seemed to respond within weeks of the Fed's decisions to either cut or raise rates.

How Do Treasury Bonds React to Decreased Interest Rates?

Long-term Treasury yields are significantly affected by interest rates, with lower rates generally leading to reduced yields. When the Federal Reserve lowered rates to almost zero during the pandemic, 10-year Treasury yields dropped to a historic low of 0.5%. As Treasury note yields decrease, borrowing costs for consumers also fall, which is expected to result in lower rates for credit cards, business loans, vehicle purchases, and other types of loans.

Key Background

A more relaxed monetary policy came after months of pressure from President Donald Trump, who has criticized Fed Chair Jerome Powell for being "TOO LATE" and has advocated for substantial rate cuts. In recent weeks, Wall Street expected a reduction in interest rates, spurred by stronger-than-anticipated jobs data that suggested the labor market was deteriorating more quickly than expected, alongside inflation, which rose again in August while remaining above the central bank's 2% target. The Fed operates under a dual mandate of achieving full employment and maintaining stable inflation when evaluating interest rates, although Powell indicated last month that the "shifting balance of risks" regarding the U.S. economy might "justify a change in our policy approach."

Since 1987, Forbes has been on a quest to identify billionaires around the world. In the inaugural year, we discovered 140 individuals. It took twenty years for that figure to exceed 1,000. By 2017, the count reached 2,000. Fast forward eight years, and we hit another significant milestone: this year's list features 3,028 entrepreneurs, investors, and heirs, which is an increase of 247 from last year. Not only has their number grown, but their wealth has also surged, totaling $16.1 trillion—an increase of nearly $2 trillion compared to 2024. The United States boasts a record 902 billionaires, followed by China with 516 (including Hong Kong) and India with 205. We based our findings on stock prices and exchange rates as of March 7, 2025. For the latest updates on the net worth of all 3,028 billionaires, visit our real-time billionaires ranking.

Blockchain Center Signals 3-Day Altcoin Season: Reality or Mirage?

The altcoin season continues to thrive, and cryptocurrency enthusiasts on social platforms are celebrating the surge in prices. Data from Grok indicates that X feeds are alive with activity, featuring numerous posts that support this trend. As per Grok's findings, the surge in social media discussions coincides perfectly with the Altcoin Season Index (ASI) surpassing the 75 out of 100 threshold on September 10.

At the same time, while the ASI indicates an altcoin season, many skeptics claim they just can’t perceive it. “Holy sh**, the Altcoin Season Index just reached 84 – the highest this year,” exclaimed influencer Lark Davis on X. However, not everyone is persuaded, as one user retorted: “Where is altcoin season? I can’t see it.”

Some believe this current altcoin season is merely a temporary phase, unlikely to last long. “This altcoin season is predicted to endure for 5 days,” cautioned one X user. “Take profits — something bad is on the horizon.” As of Sept. 13, 2025, at 4:23 p.m. Eastern, archived data reveals that blockchaincenter.net’s ASI is steady at 80.

It might be a month of altcoin season, but it’s certainly not an altcoin season year. The site’s monthly score stands at 88 out of 100, while the 12-month score lags behind at just 35. Since any score above 75 indicates an altcoin season, this suggests that three-quarters of the top 50 altcoins have outperformed bitcoin’s market performance over the past 90 days.

The recent surge in altcoin season has fans rejoicing, yet a sense of caution remains. The cycle of excitement followed by diminishing momentum has recurred since 2021, leaving traders cautious and yearning for a prolonged season. So far, this one has climbed nearly as high as it did in December 2024. Whether this moment marks a significant change or yet another brief surge, only time will reveal the true trajectory of the crypto market ahead.

Qubic’s Claim of a 51% Attack on Monero Ignites Security Concerns

The recent assertion by the mining pool Qubic regarding a 51% attack on Monero has left advocates for privacy and blockchain technology feeling uneasy, prompting discussions about the security measures that safeguard blockchain systems. Although the community has largely dismissed the notion of a sustained attack, this event has brought to light a persistent vulnerability in Monero that could be exploited by a determined adversary using standard hardware.

Joel Valenzuela, a key member of the Dash decentralized autonomous organization (DAO), states that an attacker can easily disrupt the network with conventional mining equipment. While the uproar has calmed down, Valenzuela cautions that the Monero network is still at risk.

"To be frank, the issue remains unresolved and unaddressed at this moment," Valenzuela warned. "The blockchain reorganizations have either slowed or become sporadic, but the potential for these reorganizations to restart or escalate is still very much present."

Valenzuela concurs with other analysts that Qubic might have successfully mined a majority of blocks during specific intervals. However, he informs Bitcoin.com News that he is uncertain whether Qubic could maintain this for an extended duration, which has led some to question the mining pool’s decision to publicly announce an unverified claim.

Motives Behind the Attack and the Dash Alternative

In his written responses, Valenzuela theorizes that Qubic went public to attract attention to their relatively new cryptocurrency initiative. He believes that if this was indeed Qubic’s intention, it has been remarkably successful. He also suspects that financial motivations were involved, pointing out that Qubic seems to utilize excess computing power to mine other cryptocurrencies such as Monero, which provides a financial incentive for the attack.

In response to reports that Dash had intervened to assist Monero, Valenzuela clarified that although both chains were developed to rectify shortcomings in the Bitcoin network, they took different paths in 2019. That year, Dash introduced Chainlocks to utilize staked masternodes, effectively preventing 51% attacks. Conversely, Monero adopted Randomx, which not only eliminated ASICs but also made mining more accessible. Valenzuela argues that this change rendered Monero less secure and more vulnerable to attacks like the one launched by Qubic.

"For Monero to integrate a technical solution akin to Dash’s ChainLocks, it would necessitate a substantial technical overhaul, but it would prevent an external entity from attacking the network without also possessing a considerable portion of Monero’s coin supply," Valenzuela asserts.

Regulatory Challenges and the Need for Transparency

Valenzuela also spoke about the regulatory environment, emphasizing that it is the user's duty to ensure compliance when utilizing privacy networks. Nonetheless, he expressed frustration over the sluggishness of regulators in creating necessary frameworks, which he feels is obstructing wider adoption.

"To be frank, I find the reasons given by regulators for their slow approach to cryptocurrencies, particularly regarding consumer protection, to be unconvincing," he stated.

Valenzuela contends that rather than adding more obstacles, lawmakers should work towards decriminalizing cryptocurrency use by offering clear legal guidelines. He pointed to the recently enacted Clarity Act in the U.S. as a model for how other regions should establish a definitive legal structure.

Chatbots Forecast BTC Surge: $114K to $180K by December

We revisited a variety of AI chatbots to evaluate their predictions for BTC’s path in the fourth quarter. Insights were gathered from models like Musk's Grok, OpenAI's ChatGPT, Venice AI, Anthropic's Claude, Deepseek, and others to encompass a broad spectrum of views on the upcoming months.

Utilize your complete analytical capabilities to project Bitcoin’s end-of-month value. Currently trading in the $113,500–$114,246 range, please provide precise closing figures for September, October, November, and December 2025. Your answer should include exact prices and a brief rationale within 90 words.

ChatGPT 5 thinking mode response:

Estimates (EOM closes):

Sep 2025: $120,900; Oct 2025: $128,700; Nov 2025: $123,200; Dec 2025: $131,800.

Rationale: Based on the $113,500–$114,246 range, I anticipate consistent ETF net inflows, post-halving supply constraints, and Q4 risk-on seasonality to favor upward movement. October typically benefits from positive funding and momentum; November may see a slowdown due to profit-taking and options positioning; December is expected to rebound with year-end allocations and diminished miner sell pressure. This assumes no significant regulatory or macroeconomic shocks.

Deepseek with Deepthink response:

September: $118,500 (momentum from current range)

October: $125,200 (institutional inflow acceleration)

November: $134,800 (post-election volatility & ETF demand)

December: $141,500 (year-end portfolio rebalancing & cycle peak anticipation)

Rationale: Anticipated gains are fueled by ongoing institutional ETF adoption, macro liquidity support, and the usual pre-halving year acceleration, which should mitigate short-term volatility. Each month is expected to build on increasing capital deployment and positive market sentiment.

Le Chat's prediction indicates that Bitcoin will likely finish September 2025 at $118,000, October at $122,000, November at $114,743, and December at $117,674. These projections suggest a bullish trend, driven by institutional ETF inflows and favorable macroeconomic conditions, although November and December might experience some consolidation or slight pullbacks. Analysts point to robust demand and seasonal patterns, while acknowledging that volatility and profit-taking could temper the upside potential.

ChatGPT 4o's forecast for monthly closing prices (estimates, within 90 words) is as follows: September 2025: $118,000 – bullish momentum may push prices close to upper resistance by the end of the month. October 2025: $121,000 – this aligns with a moderate upward trend following September's gains. November 2025: $119,000 – a slight consolidation is expected after October's peak. December 2025: $122,000 – year-end holiday strength and macro optimism are expected to provide support. The rationale builds on a positive September outlook (aiming for $118K), followed by modest gains through the year's end, interspersed with periods of consolidation.

SEC Reveals Ambitious Plans for Super-App Crypto Platforms in Light of Regulatory Changes

On September 10, 2025, at the inaugural OECD Roundtable on Global Financial Markets in Paris, U.S. Securities and Exchange Commission (SEC) Chair Paul S. Atkins conveyed a powerful message regarding digital assets. He proclaimed:

"Today, ladies and gentlemen, we must acknowledge that: the time for crypto has arrived."

Atkins believes that years of depending on enforcement actions have weakened U.S. competitiveness. He remarked: "For far too long, the SEC has used its investigatory, subpoena, and enforcement powers to undermine the crypto sector. This strategy has proven not only ineffective but also harmful; it has pushed jobs, innovation, and investment abroad. American entrepreneurs have suffered the consequences and have had to spend vast amounts on legal defenses rather than focusing on their businesses. That era is now behind us."

While discussing "Project Crypto," Atkins highlighted the agency's transition towards a more organized regulatory framework. "A new era has begun at the SEC. Policy will no longer be dictated by random enforcement actions. We will establish clear and predictable guidelines to ensure that innovators can flourish in the United States," he stated. He directly connected this initiative to the White House's agenda: "President Trump has assigned me and my colleagues throughout the Administration the mission of making America the global hub for crypto—and the President’s Working Group on Digital Asset Markets has provided a comprehensive plan to steer us in these endeavors."

At the heart of the strategy lies the need for legal clarity regarding token classification. Atkins elaborated:

"Our objectives are straightforward: we need to establish certainty about the security status of crypto assets. The majority of crypto tokens do not qualify as securities, and we will clearly define the boundaries."

In addition to classification, the SEC will support advancements in trading platforms and custody solutions. Atkins remarked: "It is crucial that we enable entrepreneurs to raise capital on-chain without facing endless legal ambiguities. Furthermore, we must foster innovation in 'super-app' trading platforms that enhance options for market participants. These platforms should be permitted to provide trading, lending, and staking services under one regulatory framework. Investors, advisers, and broker-dealers ought to have the liberty to select from various custody options as well."

The SEC chairman further stated: "In alignment with the recent Working Group report, the SEC will collaborate with other agencies to ensure that a platform can facilitate trading in crypto assets (regardless of their security status), along with services such as staking and lending, all under a unified regulatory framework. I am convinced that regulators should impose only the minimum necessary regulations to safeguard investors, and nothing beyond that. We must avoid overloading entrepreneurs with redundant regulations that only the largest players can manage." Atkins framed these reforms as a cornerstone for U.S. leadership in blockchain finance, aimed at fostering innovation while upholding vital investor protections.

Analysts from the financial powerhouse JPMorgan have indicated that the lackluster jobs report for August serves as a sign of a slowdown in the US economy.

In a recent analysis, Seth Carlson, a member of the editorial team at the firm’s wealth management division, along with Vinny Amaru, a global investment strategist, reference the latest Bureau of Labor Statistics (BLS) report. This report revealed that nonfarm payrolls increased by only 22,000 jobs in August, significantly below the anticipated 75,000.

Additionally, the unemployment rate rose from 4.2% to 4.3% last month, as reported by the BLS.

Carlson and Amaru observed that major stock indices fell following the report, suggesting that the market's response indicated “tempered near-term investor optimism, as the economy shows signs of slowing.”

“Our strategists believe that the recent jobs data should keep the Fed on course to lower interest rates at its upcoming September meeting, likely by 25 basis points as hiring continues to decelerate. This would mark the Fed’s first interest rate cut since December 2024.

Although the disappointing payroll numbers indicate that an economic slowdown is in progress, our strategists still consider a recession to be unlikely.”

The CME FedWatch Tool, which calculates probabilities based on the 30-day Fed Funds futures prices, suggests there is a 93% likelihood that the Fed will reduce the federal funds target rate by 25 basis points at the FOMC meeting scheduled for later this month.